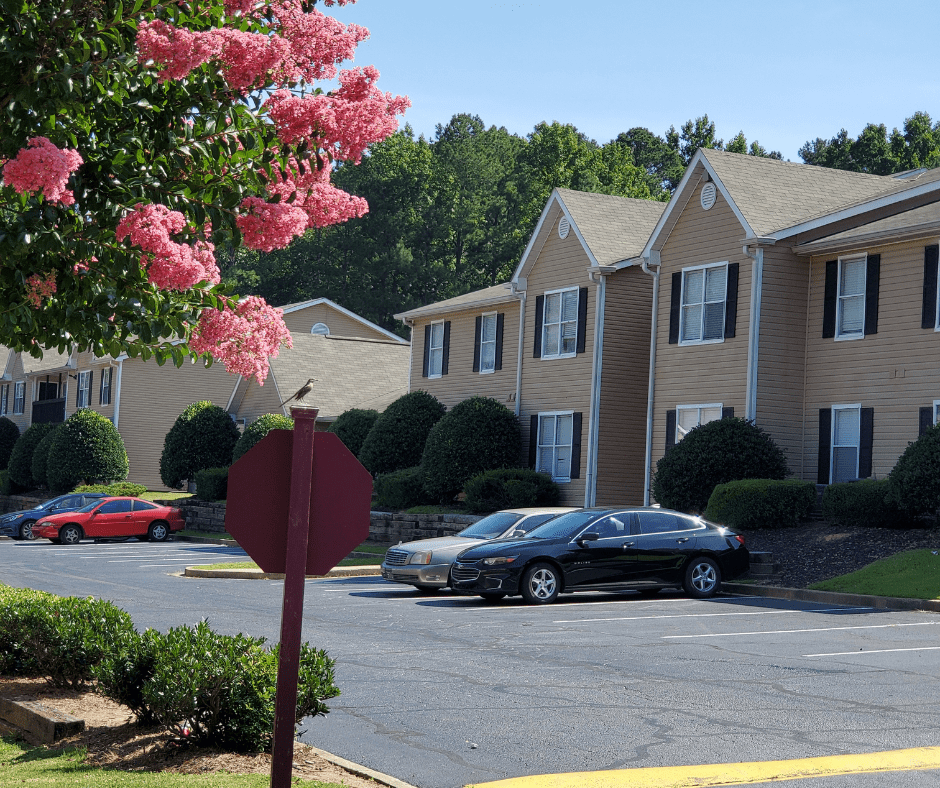

City Park Apartments, Atlanta, GA

I trust you had a great Labor Day weekend! Hard to believe summer is “over.” I guess that means we all have to go back to work! Speaking of work, I don’t think I’ve ever had a more challenging hiring environment in my career. So many folks that have stepped out of the job market, and so many companies are hiring that it’s created somewhat of a perfect storm. We’re working to leverage our 100% remote corporate work environment to hopefully lure away some top talent that is looking for that additional flexibility in their work environment. On the flip side I’m happy to see the wage growth that we’re getting because at the end of the day that helps our residents keep the lights on during this challenging inflationary environment.

ECONOMIC UPDATE

I hate to be the bearer of bad news but I think we’re seeing the top in inflation. My guess is it’ll take about 6 months for the rest of the world to adjust, and in the meantime, the Fed will continue to beat the drum about rate increases, so it sticks. We’re entering a period of slower growth as we navigate the post-COVID stimulus hangover. Some folks are trickling back into the workforce, but by and large, the unemployment numbers are steady. And to some degree, I think the modest uptick in unemployment claims is more a factor of the incentive to live off the government if you make under a certain income level. Not saying I agree with it, but you can’t blame people for doing the “math.” I hope that we’ll continue to see a pro-growth environment at the governmental level which will help set the pace for a strong economic recovery. It’s also why I like areas like Georgia, Ohio, and Texas for generally favorable business and development policies.

GROWTH IN ATLANTA, GA

One of the absolute stand outs in the job market right now is Atlanta, GA. I’m not too terribly surprised by the growth we’re seeing in Atlanta – both in absolute numbers and percentage growth. The resiliency of the job market is one of the reasons we wanted to add another deal to our portfolio there. While the country continues to suffer from a 4.3 million unit housing shortage, Atlanta feels the squeeze especially because development has slowed down recently as construction pricing has continued to rise exponentially. Existing housing stock is in ever higher demand – especially nicer quality, renovated product.

City Park-Atlanta, GA

If you haven’t had a chance to check out City Park, I think it’s a great opportunity to invest in a B-class asset that would have easily sold for 15-20% higher a year ago. While the market could go lower, I’ve never been a fan of market timing, and especially with 100% bonus depreciation going away in 2022, I like a good opportunity with some solid returns and massive tax benefits. It’s also a nice hedge to be already achieving our year 3 proforma rents on existing renovated units!

- 10-12% COC

- 15-18% IRR

- 8% Preferred

- B-Class Asset

Learn More/Reserve Your Spot HERE.