Happy Tuesday and Happy May 2nd! Crazy to think the year is already 1/3 over. All this crazy drama with the banking system and interest rates will be ancient history a year from now though. Funny how news works like that. In the meantime, Saturday was a big day for us – our little bundle of joy arrived right on time for dinner at 5:27pm. Thankfully mom and baby are doing well – aside from lack of sleep – and everyone is enjoying having a little “doll” to hold.

As promised, this week I want to talk about the reserve currency and how it affects multifamily. You’re probably wondering how in the world there’s any relationship between the two or you’re thinking this is some esoteric concept that only super-smart people care about. I get it. But I would like to simplify the situation while also laying out my thoughts on why it’s relevant to our industry.

Before we get to that, I know many of you are on LinkedIn and may have seen this already – but I posted a short video regarding my thoughts about the current market environment. I figured I would reshare it here for those who may not have seen it. We’re continuing to see a lot of fear throughout the multifamily space, but I can tell you the smart money is starting to lean in.

Portfolio Update

We review a bunch of stats on a weekly basis and there were a few that I thought would be interesting to share with you. First, in the past six months, we’ve seen average in-place rents go up 7.5%. That means that on an annualized basis we’re seeing rent growth of 15% across the entire portfolio. To me that says our business plan is working – the fundamentals of why we bought these properties and the value-add that we set out to complete IS happening.

Here’s where we sit for average in-place rents by region:

- Midwest is $872/month (13% annualized growth rate)

- Southeast is $1152/month (16.4% annualized growth rate)

- Texas is $1090/month (15% annualized growth rate)

I’m encouraged by these numbers as they show me that our core value-add business plan is working great – we just need to tighten up on our resident profile. Our challenge has been occupancy and collections. And really more-so collections since we’ve had to evict so many folks for not paying rent as the COVID relief money ended last year.

Our big goal for 2Q2023 is to hit 90% economic occupancy. Given where our collections are, that basically assumes about a 50% reduction in delinquency and a 4% increase in occupancy. We’ll still be below our final goal but as we all know, eating an elephant is best done one bite at a time.

Reserve Currency Perspective

OK, so let’s get to the meat of the blog this week – reserve currency. You may have heard some pundits talking about the death of the US dollar as the reserve currency of the world and how that will negatively effect the entire US economy. First, a primer on reserve currency from our friends at Investopedia:

- A reserve currency is a large amount of currency held by central banks and major financial institutions to use for international transactions.

- A reserve currency reduces exchange rate risk since there’s no need for a country to exchange its currency for the reserve currency to do trade.

- Reserve currency helps facilitate global transactions, including investments and international debt obligations.

- A large percentage of commodities are priced in the reserve currency, causing countries to hold this currency to pay for these goods.

Not all currencies are created equal. Some countries are able to stabilize their own economies by providing easy access to more stable currencies (like the USD). In countries that experience a lot of volatility (think somewhere like Turkey today), inflation is rampant and it’s very difficult to plan ahead. Making the availability of a larger, more stable currency a priority can help ease the economic pain of the situation.

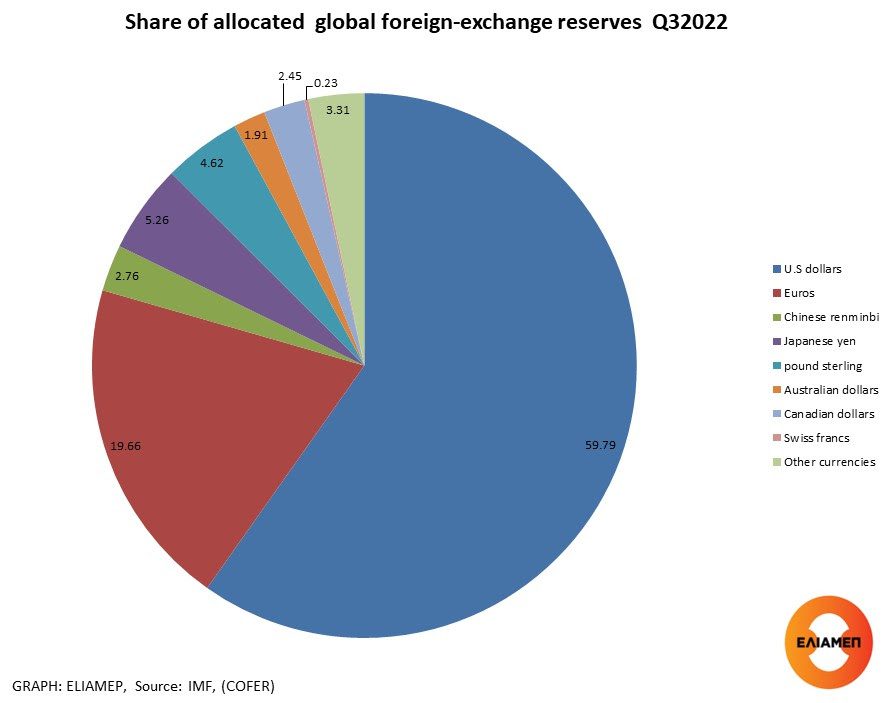

The USD is the defacto reserve currency of the world. The second largest is the EURO but it’s not really a close second. The USD reserve currency is more than 3X that of the EURO. The Yuan isn’t even a close third at 1/4 of the EURO reserve. Behind that you have the Pound Sterling (which 100 years ago was the defacto reserve currency with about 60% of the world reserves). The news makes things feel as though the demise of the USD is imminent. And while the IMF and other “global” organizations tend to promote this notion, reality is still reality. There’s no guarantee that the USD will stay forever (most currencies don’t), but this process takes dozens if not hundreds of years to happen.

One of the KEY ingredients for reserve currency is stability. Think about the political stability of the countries that are touted as “reserve” and ask yourself – are they really the most stable in the world? People aren’t stupid – a reserve currency isn’t built on instability. Size and scope, sure. Growth, sure. But stability is paramount. And any country that has a quasi-dictatorship really isn’t a great long-term solution.

The notion that we’re suddenly seeing the end of USD world reserve currency is more the news cycle versus reality. But the tricky part is that sometimes news can become reality if we’re not careful.

So what does this all have to do with multifamily? Well, having a world reserve currency allows the Fed to do things that otherwise wouldn’t be possible – like flood the world with a ridiculous amount of dollars (to stabilize our economy when needed) and get away with it. And it makes foreign investment in USD the preferred place to park money. Both of these things make it easier for multifamily owners to borrow capital at better rates and continue to generate solid returns on their capital.

From a different angle, if the Fed decides to continue increasing rates to combat inflation, foreign investment will see that as a stabilizing action and will continue to look for ways to own USD and US assets. That, in turn, benefits US multifamily assets. If the Fed cuts rates and lets inflation run, foreign investment might not be likely to invest in USD, but our cap rates would go back down, valuations would go back up, and rent increases would continue to rise on an above-average pace – all benefitting the multifamily business.

Bottom line? Despite the fear in the market, multifamily investment in the US will continue to be one of THE best investments in the world for long-term, low-risk generational wealth minded investors. I’m good with that!

That’s all for now! Thanks for reading and have a great week!

Â