Midwest Portfolio, Stonebrook Apartments, Scottsburg, IN

Running a day behind here this week. Yep, been one of those weeks already. Trust things are going well for you. While these are tough times if you’re looking to acquire real estate and have an eye for the long term – I think it can also be a good time to step back and make sure your portfolio is aligned with your objectives. Along those lines I wanted to do some high-level review of risk profiles in the multifamily space.

ACQUISITIONS

But before we do, a quick note on the acquisitions side. I’m happy to announce that we’ve hired a senior acquisitions analyst who I look forward to introducing here in the coming weeks. I’m also looking forward to dramatically improving our deal flow because in this market it’s more important than ever to dig through literally hundreds of deals to find a good one. As they say, when the going gets tough, the tough get going! We’ve got several opportunities in the hopper, as usual, and hope to have some good news soon. Been making some pretty solid headway with more and more off market deals, too, so I think we’re getting closer to a winner.

INVESTMENT STRATEGIES

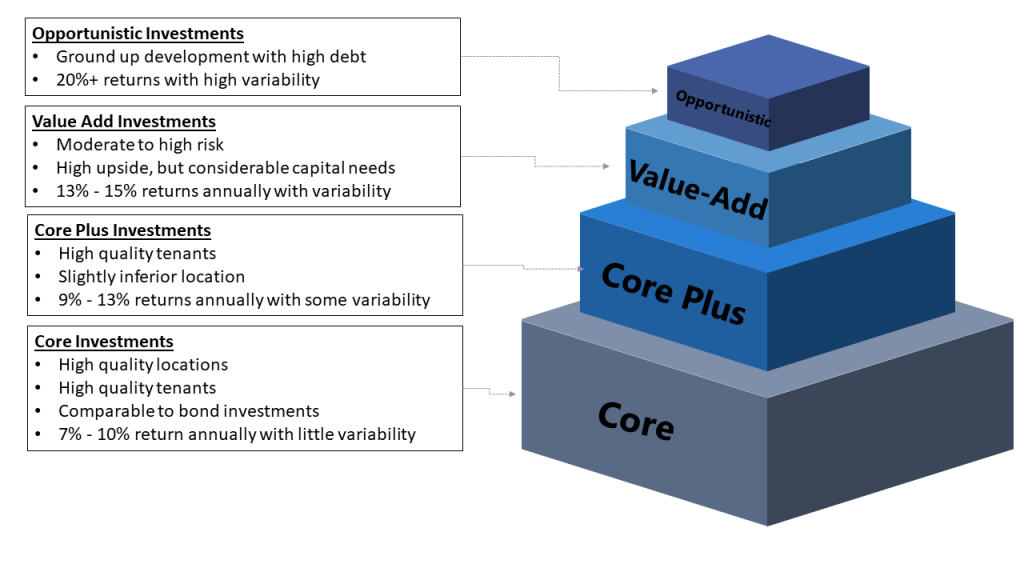

In the multifamily market there are, generally speaking, four categories of investment strategy: Core, Core Plus, Value-Add, and Opportunistic. These categories relate to the risk profile, quality, location and strategy of a particular property. The graphic below is a nice visual representation of what we’re talking about. We primarily focus on Value-Add opportunities but have also been looking at Core Plus because we feel the spread (or increased return) for Value-Add, in some locations, doesn’t justify the increased risk. Sometimes we would rather get a slightly lower return on a Core Plus property with a dramatically reduced risk. I’ll talk more about that in just a minute.

VALUE ADD VS. CORE PLUS

Value-Add real estate is riskier than Core Plus and generally has higher returns. Value-Add deals are riskier because they involve renovations (which can be poorly executed, over budget, too slow, etc), resident turnover (many times large portions of the existing resident base need to be evicted as part of the value-add turnaround), and sometimes low initial occupancy (due to previous mis-management). There is huge execution risk associated with these types of deals and the quality/experience/reputation of the sponsor is extremely important to the overall success of that project.

When we purchased our property in Beavercreek, OH, we didn’t know that one year later a tornado would rip the entire property apart. We were in the middle of our value-add plan! So, on top of having to rebuild the entire property, we started at 0% occupancy. Fast forward to today and that property is about to hit 100% occupancy for the first time since we’ve owned it (kudos to our absolutely amazing team). It could have easily sunk us, but we were able to navigate the renovations, the rebuild, the low occupancy (doesn’t get much lower than 0%), and management challenges (we had to fire two managers along the way – we now self-manage) to bring the ship back.

During this time our investors received 20% of their investment back in distributions and now we’re just about prepped to do a supplemental loan and get a sizeable additional chunk back. Long story short, value-add, aside from the weather, is riskier but can, and should, produce higher returns than Core Plus. Typical Value-Add deals return 13-15% IRR (depending on leverage, etc) and this is our “bread and butter.”

THE CORE PLUS MARKET

We’ve started working the Core Plus market too, though, because it has higher quality residents, better location, and newer vintage properties. All of these factors make for a lower risk investment. And here’s a key nuance that could come into play at some point – Core Plus assets generally hold their value better than Value-Add deals during a downturn. While I don’t pretend to know where we’re headed, I do think it’s prudent to have a portion of your portfolio invested in Core Plus type properties. We feel like there are also opportunities to add value to certain Core Plus properties where others might overlook the need for interior upgrades, lack of “wow” factor, and superior resident experiences. Generally these deals are a little lower return, 9% to 13% annualized return (IRR) but could provide a nice hedge against the higher risk Value-Add strategy. Our ideal is a Core Plus Value-Add deal. Is there really such a thing?!

OPPORTUNISTIC DEALS

On the flip side of this is the Opportunistic deals (i.e. ground-up development). High risk, subject to boom-bust cycles, etc. We won’t dig into this end of the spectrum as I wouldn’t recommend this for most investors unless you’ve got some play money to invest. The going is great while the market is good – but it shuts off quick and you can lose everything.

I hope that information was helpful as you assess your investment sponsorship group and think about where you want to be in the risk/return profile.