Hope you had a great weekend and welcome back! Lots in store for today but the big event around here is the groundbreaking for our St Pete Portfolio development happening this morning! Always a fun day. I’m incredibly honored and blessed to be building 220 units of Class-A space in this amazing market. The continued growth of St Pete combined with the relative affordability of our units is such a great story. Not only that, we’re connecting our community (Ellington Place) with local community by showcasing artists and their work right on our walls. It’s all about building community!

Our excitement about this new development (which will hit the rental market early 2024 and stabilize late 2025) is also tempered by the fact that we’re in the middle of a very challenging time for multifamily (and all real estate in general). The office market is probably about to implode. Small investors and large are adjusting their investment paradigms as we navigate these crazy waters. If interest rates stay high for an extended period of time, the only deals that will survive are those that cash flow. Most deals are in that position but some aren’t. In general, deals done mid-2021 to mid-2022 at the top of the market that haven’t had time to reposition are struggling and will only survive if their operators are able to come up with the necessary liquidity to “survive to 2025”. This scenario also applies to any deal that has variable interest and needs a refinance and/or didn’t have a rate cap.

All that being said, the reason I don’t believe there will be a massive crash (regardless of multifamily or other) is that the properties in this “cash flow challenged” bucket account for a small percentage of the overall number of real estate properties out there. Even if every single one of them defaulted, I doubt it would trigger a massive sell-off in real estate. There are literally billions in capital sitting on the sidelines waiting for “the great opportunity” that won’t come. It does mean that there will probably be select opportunities for well-capitalized and well-connected buyers. And when people finally realize there won’t be a “great opportunity”, it will be a mad rush to place capital – and I would prefer to be in front of that wave. A rising tide lifts all boats.

IMN Mid Market Recap

Last week was a productive time in Atlanta at the IMN Middle Market Multifamily Conference. It’s one of the best events to meet brokers, vendors, and fellow operators. I was able to spend some quality time with mortgage brokers, attorneys, prop tech providers, and co-GPs. I also walked away with a really good potential insurance contact that I’m hopeful will help us in our search for the “holy grail” of insurance. Probably a little too optimistic but can’t hurt to try.

There are also some really good industry panels. Each one focuses on different aspects of multifamily and folks discuss what’s happening from their perspective. The industry panels are not so much new information as they are a confirmation of what we’re already seeing in the market. Cap rates haven’t moved much. Pricing spreads are still very wide and not many deals are getting done. The patient capital is only investing in deals that are further out (i.e. development projects in top markets). Agency debt is becoming more competitive again.

Large institutional capital is about ready to start re-assessing the market (now that the expected rate increases are just about complete). Small investors are probably side-lined for a while given the stock market declines, layoffs, and uncertainty. Housing demand continues to climb and the fundamentals are holding firm albeit with slower overall rent growth. There’s a noticeable difference, however, between Sunbelt and Midwest markets vs others. High growth (Sunbelt) and value (Midwest) markets are outperforming!

Texas Property Taxes Are A Problem

The governor and lieutenant governor are arguing over how to allocate the property tax savings that were passed by the Texas House. The bill is set to return $16 billion to taxpayers. Texas has become the 7th highest in the nation for property taxes – and that’s an average that includes huge swathes of land with much lower property taxes. It’s becoming a problem for both owners and landlords as greedy counties ramp valuations at meteoric rates in a grab for massively increased revenues. It’s beginning to put a crimp on Texas’ competitive edge in the overall affordability rankings.

We’ve seen a similar massive increase in property taxes at our properties. Even though we appeal them each year – winning thousands in concessions – the increases are virtually impossible to keep up with. Like most economic corrections, we’re seeing a “catch-up” on real estate taxes combined with slowing rent growth. Rent growth typically reacts much quicker than tax appraisals so when the economy slows, cash flow gets hit on both sides. It doesn’t last forever but certainly creates some short-term pain.

Britain’s Money Problem Is Our Opportunity

Overall real estate development return premiums for our neighbor across the pond have been decimated by a combination of skyrocketing labor costs (we haven’t seen anything over here relative to what they’ve got) and much higher overall inflation (8.7% in April). Construction just doesn’t make sense right now and those who are sitting on deployable capital are looking to the US as an alternative.

In my career, I’ve seen this scenario many times before. Back in the early 2000s, capital from Germany was the best because investors were seeking a better yield vs what Europe had to offer. Post-GFC, money was flooding in from Middle East pension funds ready to capitalize on the discounted basis of real estate in the US. While it’s important to understand our national market and understand capital flows, it’s also important to understand and be cognizant of the international market and how it could affect our US real estate market.

Economic Update

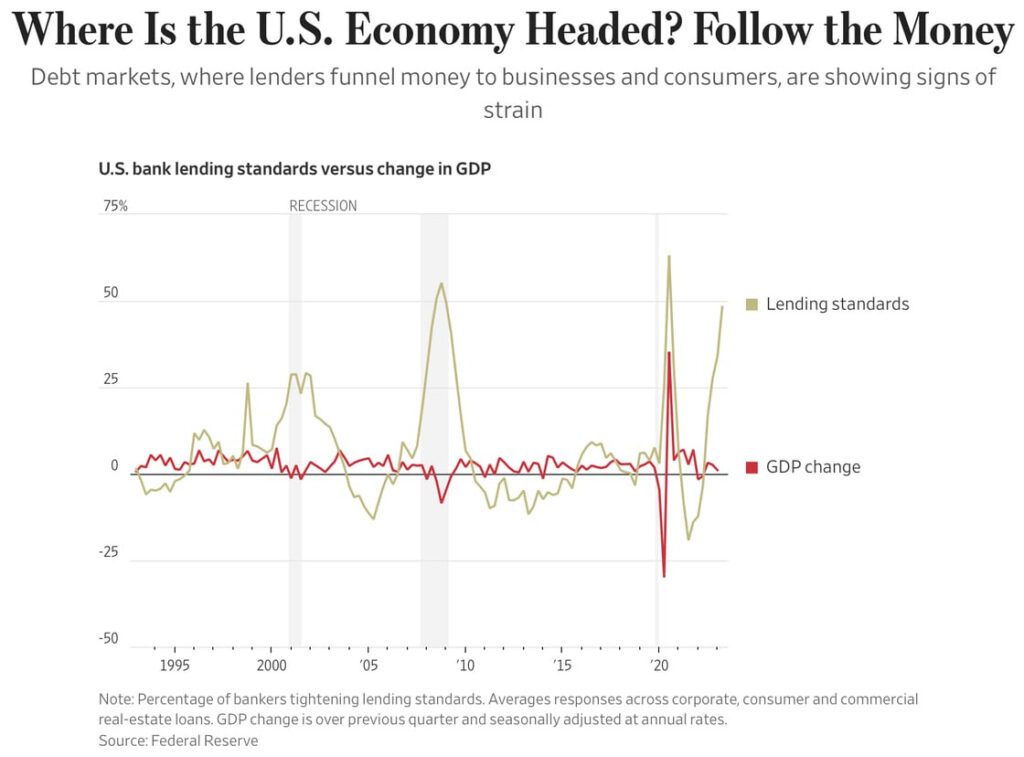

We’re continuing to see conflicting economic data on where we’re headed. A great example of economic weakness from this past week is the chart above. Lending standards have tightened dramatically while overall GDP is shrinking. As you can see in the past, when lending dries up, the economy shrinks. Makes sense since capital is what gives everyone the ability to invest and grow. The Fed has been a huge proponent of keeping capital markets liquid throughout the recent downturns – learning from their mistakes in 2008-2009. However, we’re seeing a tightening of credit across the spectrum which will most likely lead to a significant drop in overall economic strength.

On the flip side, the job market appeared more resilient than expected with new jobs created way outpacing expectations at 339,000. Even so, given the convoluted methodology used to measure unemployment, that measure jumped up to 3.7%. Lots of mixed signals as we enter the twilight zone of economic policy, political gridlock, and overall uncertainty.

One negative and positive all wrapped in one – the debt ceiling agreement. It basically kept government spending unchecked. This spending is the largest menace to inflationary pressure and received the equivalent of a slap on the hand. It’s pitiful and will continue to cause the average American more harm as it continues to grow. I’m more concerned about government spending than anything else. It has the ability to cause inflation which will lead to the Fed raising rates way too far to combat it.

Where In The World Is Robert?

Just in case you missed it last week – I’ve got a few trips planned in June and would love to connect if you’re in these areas. I’ll also be doing site visits throughout the Southeast so feel free to join me walking units.

June 7-9, Atlanta, GA

NAA Apartmentalize

- The National Apartment Association has a once/year event called Apartmentalize where you get access to probably the largest group of providers and operators in the multifamily space. Everything you could want related to property management – all in one place!

June 12-14, Charlotte, NC

MFINCON (Multifamily Investor Nation Conference)

- This is probably the largest meeting in the country of passive and active investors all focused on syndication. I’ll be speaking at MFINCON along with many of my good friends and colleagues in the business.

That’s all for now! Thanks for reading and have a great week!