Hope you had a great weekend and welcome back to a new week! Last week I was up in Atlanta to review our Avenue33 and City Park deals. We walked units, discussed interior finishes, renovation progress, resident challenges, and the ever important maintenance to-do list. A critical success factor in any business is being able to prioritize a list that is much longer than you have time in the day. Being able to regularly review that priority list and make thoughtful decisions is something we focus on each day. I try to teach my team to write everything down (because if you don’t document it, it doesn’t exist) and then regularly review the list and tackle the top 5-10. It’s amazing what you can get done over a period of time when you are disciplined with your time.

I like to use the analogy of paying off credit card debt. If you wait until the $10k is in the bank before you pay it off, it’ll never happen. On the other hand, if you pay $100 here and $50 there as you’re able, magically the credit card debt disappears! The small things in life done consistently usually add up to much more than the big events that occur only once in awhile!

But back to our site visit…It’s been quite the challenge with 12-month eviction process (is that even an eviction process? feels more like a money grab) but the team is fighting the good fight. We’ve been able to build a solid team and with Carissa’s (RVP) leadership, we’re getting the right folks in the right place. Both properties look great and while our current cash flow is pretty ugly, I still continue to believe our business plan is solid, albeit delayed with the delinquency mess.

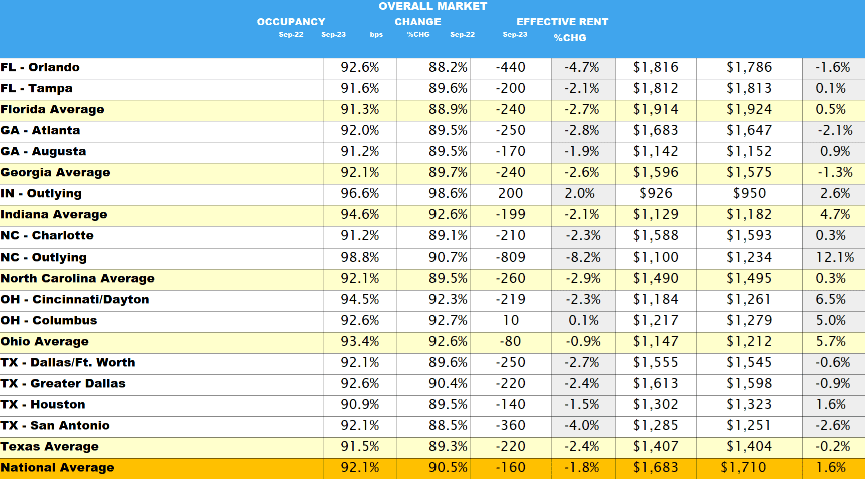

Average Occupancy Close to GFC Lows

A recent ALN occupancy report showed that we’re currently sitting at a decade low occupancy in most markets across the US. No one wants to admit it or report it, but that’s where things are at. Most markets have fallen 150-250 bps occupancy in the past 12 months and it’s probably not getting any easier before it gets a little worse. We’re seeing the pressure around us as competitors post increasingly aggressive specials to try and lure residents to their properties. Thankfully customer experience is also very important and we’re big on being friendly. I think it’s some of the reason we’ve been able to reverse the national trend and actually increase our occupancy by 260bps portfolio-wide over the past year – and we’re just getting started!

That being said on the national occupancy challenges, the vast majority of markets also experienced a 0-2% increase in rents. The national average rent increase was 1.6% for the trailing twelve months ended 9/30/2023. With the challenges of occupancy, those who are renting are willing to pay more for where they live (echoing the increased costs of insurance, taxes, payroll, etc that have affected multifamily owners). With our value-add strategy we’ve been able to do a little better than this national average – pulling in an 11.5% portfolio-wide rent growth in the past year and a 3% rent growth during the third quarter.

Over the last three years, student loan payments have been an expense that most of the forty-three million borrowers across the country have overlooked. However, they have now returned, and it remains to be seen how this will affect residents who are also dealing with rent increases. The financial position of households has already begun to show signs of cracks, and it is likely that the simultaneous pressure of paying student loans and rent will have a negative impact. Moreover, the typical seasonal pattern in multifamily demand and rent growth has returned this year, which could lead to further softening in the market over the next few months.

Screenshot 2023-10-16 214456

Beating The Trends

We’re tackling these market challenge by building out our physical team and building out our “software” team. With our new CRM and AI integration, we’re seeing a huge influx of leads. Our challenge now is to increase our conversion rates from the low single digits to something in the mid-teens.

My focus is also centered around providing the best possible leads to our sites and our next phase of the marketing push is really honing our marketing channels (FB vs IG vs Apartments.com, etc, etc) and our marketing content. Part of that marketing content is your SEO strategy. SEO effectiveness is super critical to achieving a high degree of exposure to your desired renter demographic. While being easily accessible via a chatbot or 24/7 agent are important regardless, our goal is being able to target the right resident for our complex. Sometimes that also requires geofencing to build brand recognition in an area where we have effective competitors. Many of our deals also need brand recognition because we’re executing a value-add strategy that is essentially targeting a new/different resident demographic that does not otherwise know that our property is an option for them. If the neighborhood was previously crime-ridden or poverty stricken, many folks will stay away from areas with those stigmas. It’s our job on the marketing side to change that perception.

Portfolio Highlight: L&L Portfolio, Jacksonville, NC

I’m still working my way through the September financials (which were done in record time this month thanks to some great leadership from our new CFO, Rebecca), but had one particular win that I am very excited to share. Our L&L Portfolio, which still has a ton of room to grow rents, posted a profit for the first time in over a year! Absolutely amazing work by our team out there in Jacksovnille, NC. Just to clarify, we’re not talking about positive NOI, we’re talking about after debt service – which is quite a feat when you have bridge debt that’s gone up as much as it has.

I’m excited to see that growth and momentum. It’s been a bit of a tough ride for our investors since we’ve had to pause distributions and get the deal back on it’s feet. The expenses are a little different than what we had in our pro forma – from coastal insurance skyrocketing, to payroll and real estate tax increases, to higher interest expenses – but this deal is becoming a winner as we work through year 2 of our business plan. Our next big hurdle is replacing our rate cap in April of 2024 and we’re already planning ahead since it could be close to $1MM. No one knows what will happen in the next 6 months, let alone the next couple years, but we can continue to manage the property well and drive NOI so that we can handle the storms ahead.

Thanks for reading – that’s all for now. I hope you have a great week!