Hello and happy Tuesday! Despite the current events happening in the world, our focus remains on multifamily housing within the USA. This week, we can expect Core PPI, Core CPI, and Consumer Sentiment reports, which will keep us on our toes. In case you missed it, last week, the 10-year treasury hit another all-time high within the last 15 years. Ironically, that same level was an all-time low in 1998. Although I believe we haven’t seen the worst yet, it’s important to remember that when others are fearful, we should consider being “greedy”.

Due to low demand for bonds compared to supply, the yield is pushed upward. This could be attributed to the Fed’s ongoing quantitative easing and the overall concern for the debt level of the US government. Currently, equity investors are not panicking yet (although the S&P is below its August highs).

Nonetheless, in the interim, this environment will make it increasingly difficult to complete refinances of existing assets (and especially those purchased in the last 1-3 years). With tightening lending standards and higher rates, proceeds on those refinances are dropping fast. As an operator the most important thing you can do is push revenue and NOI and do the best you can to meet the headwinds.

This is one of the reasons we are pumping a ton of energy into our AI leasing system. We are seeing opportunities to improve both lead sourcing as well as lead conversion. With AI assistance and better data, we’ll be able to pinpoint where our folks need help and where we need to point our marketing dollars.

Similarly, we’re focused on resident retention in properties where we have steady, paying residents. A resident saved is a turn cost avoided – and with labor and material costs, turning a unit for a value-add deal can easily cost $2-3k (or more). That’s the equivalent of $200/mo – so if you can get a $50/mo rent bump on a below market unit that is paying consistently, it might be the right time to take it. Other factors that weigh into our decision process: how many units can we turn each week (in-house plus third party vendors), how much working capital do we have to work with, can we get a large enough bump in rent to justify the renovation, and do we have enough traffic to accommodate the turnover while avoiding costly excess downtime.

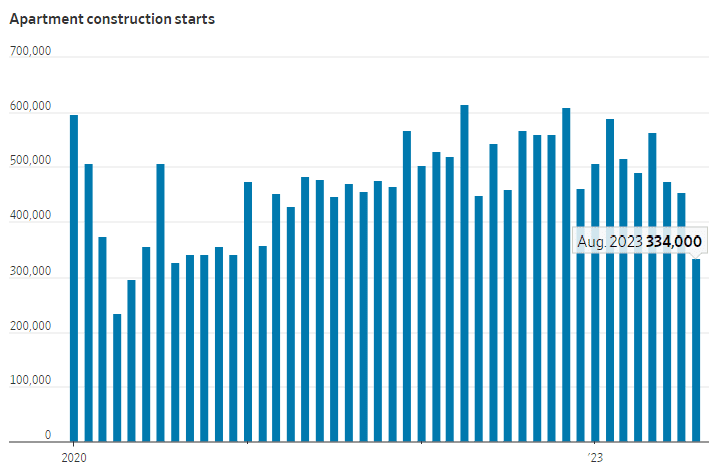

As for multifamily investors, most are holding steady with few transactions happening. However, new starts in the development side are declining rapidly (60-70% in some areas) and creating huge opportunities for those bold enough to step forward.

Multifamily Development

Residential construction has been negatively impacted this year due to higher interest rates. The Census Bureau reported a 41% decline in apartment building starts to a seasonally adjusted annual rate of 334,000 units in August, compared to the same month last year. This marks the second time there has been such an annual decline since the subprime housing crisis. Unfortunately, based on the development pipeline, building is expected to significantly reduce for the next two years. The high cost and scarcity of construction financing have made new projects unviable for builders, who have cited it as the primary reason for their inability to continue. Banks have increased their reserves to support troubled property loans and are lending far less frequently. Additionally, a well-known multifamily bank lender recently mentioned that they would be pushing the envelope to get to 50% LTC. As a result, residential construction spending has declined by over $50 billion this year. The construction sector has also experienced a decrease in hiring and job openings, and builders and analysts predict an increase in construction layoffs as building starts continue to decline.

The big challenge for most lenders (and investors) is modeling the exit. What will your property valuation look like when it’s complete? Lenders are modeling an exit at a mid 6% cap rate. That’s tough to pencil if you’re going in with anything lower than that on yield-on-cost. Meaning, you really need a project that can product a high 6s (preferably low 7s) yield-on-cost to make the numbers work. What kind of rent growth would you need to see in order to sweeten this number? Right now rent growth looks a little scary. But we all know what happens when any economic system gets shocked – first it swings one way, and then back the other way. So where rent growth is soft right now, we’re going to see the opposite in 2 years when supply is constrained and demand remains robust.

Many economists are beginning to talk about the idea that higher inflation and interest rates may be here to stay. Some folks fear this as a terrible thing as though it will prevent all multifamily from making sense. Here’s the corollary to this hypothesis – rent growth will accelerate and values will accelerate to meet this new norm (if it happens). Thus a 6% cap exit is completely understandable and doable, but we need to adjust our rent growth to anticipate what will likely happen on the revenue side should this scenario actually occur.

I’m still modeling our deals at a 3% rent growth and they’re penciling close to a 7% YOC. I’m happy with that as I think it gives us some cushion for upside. With construction slow downs and overall costs headed down over the next 24 months – combined with rents that will pick back up considerably as supply is constrained – I see continued opportunity for investors and lenders who have the risk appetite to move forward in this environment. I remember buying in 2012. It was scary at the time but what a great time to buy.

Value Add Market

We’re not seeing much of a change in the value-add market yet. Pricing continues to remain strong and overall values are holding up well. I think most people understand that if you hold on to real estate long enough, you’ll always make money. The biggest challenge in today’s market is overcoming the ballooning cost structure that comes from insurance, tax, and interest hikes.

Market Intel

We’re seeing strong economic drivers in our core markets. I wanted to share a nice piece from my friends at Lee & Associates regarding the Cincinnati market.

We also received news that Leidos, one of the largest companies involved in airport security, is opening an office in San Antonio!

Also exciting for the Lone Star State, Texas is now one of three bioscience hubs in the country (along with Boston and DC) after Dallas landed a $2.5 billion contract.

And last but certainly not least, my neighboring city of St Petersburg, FL – where we have an exciting 220-unit project on the way – just confirmed the Rays are staing!

$1.3 Billion ++ For St Petersburg, FL

That’s all for now. I hope you have a great week!