It’s another Tuesday after a holiday (they all lined up quite nicely this year so far) and we’re back at it for another week. While our leadership team and most of our onsite teams were working yesterday (no rest for the weary), we offered the day off to anyone who wanted to take it. On our leadership call yesterday we spent a minute discussing HR updates and for the first time in as long as I can remember, things were fairly muted. We’ve got a pretty stable team right now which I’m very thankful for.

We see a lot of turnover and it’s been incredibly difficult to find competent folks to fill the many positions that it takes to run our business. Our big focus right now is all centered around occupancy, retention, and delinquency. Our new VP Marketing, Bobby, has hit the ground running and is busy training our onsite folks and building out accountability processes so everyone knows how they’re doing. Patrick and our RVPs are doing weekly checkup calls and training on collections so each of our staff understands how to make collections effective. Our AR Policy is very thorough and effective so it’s a matter of building the discipline into our weekly processes onsite.

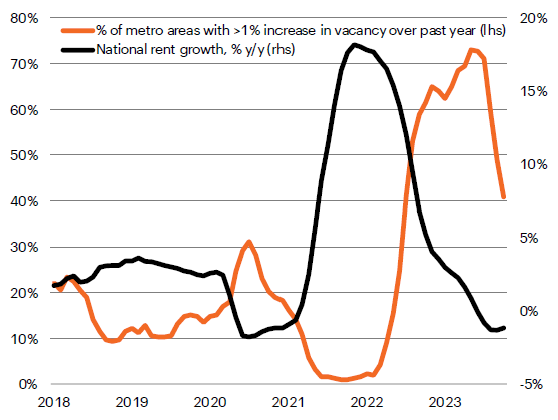

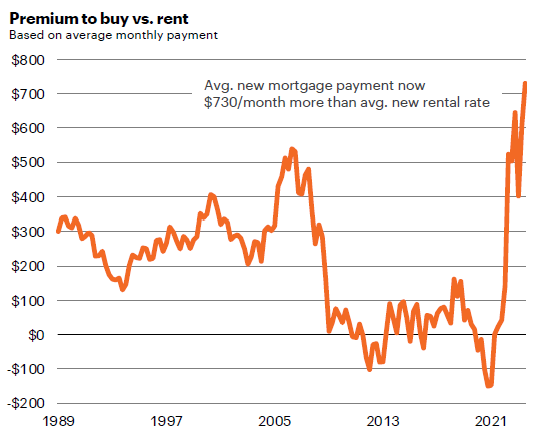

Rent Growth and Premium To Buy Vs Rent

When the COVID pandemic first hit, the multifamily industry faced the challenge of keeping residents in their homes during widespread layoffs and economic shutdowns. Unfortunately, the industry is still struggling with the impact of these challenges on rent payments. However, the job market has shown remarkable resilience and the Federal Reserve’s injection of stimulus money has resulted in a strong demand for rental housing. On the other hand, there has been limited new supply until recently, which has led to a softening in rent growth. Interestingly, there has been a significant decline in the commencement of new multifamily projects due to the sharp increase in interest rates over the past 18 months. This decline can be attributed to the lengthy development cycle that involves entitlement, permitting, and construction processes.

Furthermore, the cost of purchasing a property has skyrocketed, resulting in a staggering $730 per month difference between buying and renting. This significant price gap serves as a compelling incentive for individuals to opt for renting instead of buying. The increasing demand for rental properties sets the stage for a potential substantial surge in rent growth over the next 1-2 years, especially as the supply of new properties slows down while demand remains strong. However, it is worth considering that as interest rates decrease, mortgage rates will follow suit, effectively reducing the disparity between buying and renting. I anticipate that, unless there are ongoing external interventions, the market will eventually stabilize around its historical average, making buying slightly more expensive than renting. This long-term trend is projected to continue driving the demand for multifamily properties. Moreover, it is one of the reasons why I am highly optimistic about the prospects of Build-to-Rent (BTR) communities. BTR offers a solution that addresses both concerns simultaneously – the opportunity to reside in a home while renting it, all within the luxurious amenities of an apartment complex.

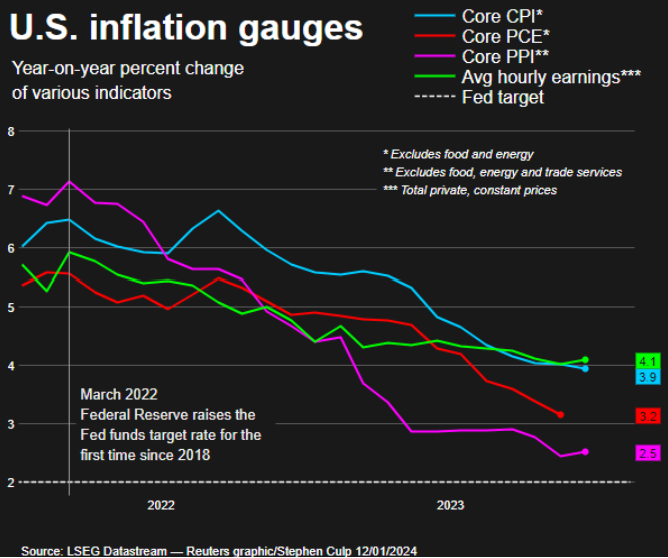

Economic Update

Last week, we received some seemingly contradictory information about the direction of inflation, which is in line with the current state of the market cycle. Consumer inflation rose more than expected, but producer inflation fell below expectations. What does this mean? Firstly, it’s worth noting that while consumer inflation did increase, the rise was not significant. There have been a few ups and downs along the way, which is normal. Secondly, the cost of housing has a significant impact on consumer prices. As we know, housing costs (primarily rental rates) have been declining for over a year now, and this takes some time to fully reflect in the data, with a lag effect of at least 12 months.

Let’s discuss producer prices and how they impact consumer prices. Producer prices measure the cost of raw materials used in manufacturing consumer goods. As raw material prices fluctuate, they eventually influence consumer prices. Recently, producer prices have unexpectedly dropped more than anticipated and have been negative for the third consecutive month. A single month of decline could have been a minor issue, while two months could have been a more significant problem. However, with three consecutive months of decline, we are seeing a strong trend that is likely to have an effect on the Consumer Price Index (CPI) in the near future.

Portfolio Update

We’re closely monitoring the economic indicators to determine the timing and amount of rate cuts that the Fed will make in 2024. Based on this, we will assess each deal and make wise decisions on whether to refinance and lock in a lower rate or keep the floating rate debt for another year to benefit from the future rate cuts. My intuition suggests that a combination of both options could be the best approach. Refinancing will help reduce risks and unlock capital, while waiting for another year could lead to significant reductions in interest carry costs, resulting in much better valuations and stronger refinance opportunities.

That’s all for now! Have a great week!