Atlanta, GA

“We don’t have to be smarter than the rest.

We have to be more disciplined than the rest.”

-warren buffet

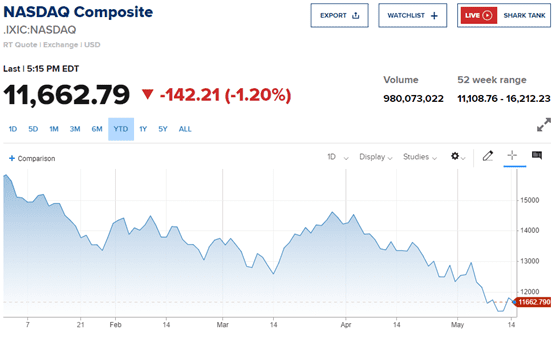

Happy Tuesday and welcome back to another exciting week in the stock market! I’m not your financial advisor, but yowsers…what a ride! As a one-time Wall Street guy myself, I can’t help but have a little fun with all the excitement happening. Here’s a brief walk down memory lane in a snapshot (don’t judge, I’m still a NASDAQ guy – although it’s all electronic now):

Here’s my point – we started the year at around 15,800 and we’re now at around 11,600 – roughly a 26% drop. Two things that I think are important to point out – and one that’s just for fun. First, the stock market hates fear. Two, the stock market doesn’t like rate increases that may lead to a recession. Lastly, if you think we have it bad, check out the Russian stock market performance. Stability is security and vice versa!

I love real estate, and particularly multifamily, because of its stability.

STOCKS

If you didn’t sell your stocks last year before the rate hikes, the wars, etc. it’s too late now. Just hang on, it’ll come back, and use any spare cash to invest in real estate. If you did sell last year, nice job! Warren Buffett has been on a buying spree (when others are fearful, you should be greedy) after building up his cash position towards the end of 2021.

DISCIPLINE AND DILIGENCE

Which brings me to the quote at the top of the email. I’m not a market timer and I don’t pretend to be the smartest guy out there. While both help on occasion, I don’t believe either are required to be tremendously successful. Discipline/diligence over time is the true key to success. We’re going to keep at it, one deal at a time, and I expect to weather any storm that may come our way because we’re disciplined in our investment approach.

COMMON SENSE INFLATION SOLUTIONS

I’ve been very happy to see a prominent business guy, Jeff Bezos, correcting the inanity of Washington politics when it comes to taxes and inflation. The White House suggested that somehow increasing taxes would solve our inflation pain by taking from the uber wealthy to give to the less-wealthy (we’re all wealthy here in America relative to the rest of the world). Bezos correctly noted that a multi-trillion dollar spending plan passed in March is a prime example of something that causes inflation (if history is any guide, he’s got a point). He also noted that inflation hurts the poor most – and I agree. So how do we solve this problem? Wage growth. We give workers a fair day’s pay for a fair day’s work.

Again, Amazon has been ahead of the curve offering a $15/hr minimum wage back in 2018 which was bumped to $18/hr last year. As you can probably tell I’m a big proponent of market economics (with a healthy dose of accountability). As with all transition, there has been some pain as smaller companies have suffered while workers shifted to higher paying jobs at Amazon. But at the end of the day, after the dust settles, the hourly worker gets the benefit. I’m all for that. Multifamily is driven by jobs. Period. And when our residents make more money, they can sustain the rent increases that are increasingly being driven by our own payroll cost increase and skyrocketing tax and insurance costs. It’s a win-win.

OK, I’ll get off my soapbox. Back to inflation and why I don’t think we’re in trouble – yet. With a 26% correction in stock valuations, we’ve just seen $12 trillion (yes, with a T) wiped off the board. You talk about combatting inflation! Put a little fear in the market and, poof, $12 trillion goes bye-bye. Let that sink in for a bit and my bet is we navigate a soft landing. In the meantime, keep your eye on multifamily!

ATLANTA UPDATE

Speaking of which, I’m reviewing our final tweaks to the slide deck for our latest greatest deal in Atlanta. Very excited to share that with you hopefully by the end of the week so you have some leisurely weekend reading to peruse.

Thanks for reading. Have a great week!